Recognizing Jumbo Loan: What You Required to Know for Deluxe Home Purchases

Recognizing Jumbo Loan: What You Required to Know for Deluxe Home Purchases

Blog Article

Maximizing Your Home Buying Prospective: An Extensive Take A Look At Jumbo Finance Funding Options

Navigating the intricacies of jumbo lending financing can significantly improve your home acquiring potential, specifically for high-value residential properties that surpass traditional funding restrictions. Recognizing the eligibility demands, consisting of the need for a durable credit rating and significant down repayment, is crucial for possible purchasers (jumbo loan). Additionally, the competitive landscape of rates of interest and connected charges challenges both presents and chances. As you consider these variables, the concern stays: exactly how can you purposefully position on your own to maximize these funding choices while decreasing dangers?

Recognizing Jumbo Loans

In the world of home mortgage financing, jumbo financings act as a vital alternative for customers looking for to buy high-value properties that exceed the adjusting car loan restrictions established by government-sponsored enterprises. Normally, these limits vary by region and are established each year, usually mirroring the regional real estate market's characteristics. Jumbo car loans are not backed by Fannie Mae or Freddie Mac, which differentiates them from standard finances and presents various underwriting criteria.

These car loans generally feature greater rate of interest because of the regarded risk related to larger finance quantities. Customers who select big funding normally require a much more considerable monetary account, consisting of higher credit history scores and reduced debt-to-income ratios. In addition, big loans can be structured as fixed-rate or adjustable-rate mortgages, enabling borrowers to select a payment strategy that lines up with their financial objectives.

The significance of big car loans extends past mere financing; they play an essential role in the deluxe property market, making it possible for purchasers to get homes that stand for considerable investments. As the landscape of home loan choices evolves, recognizing big loans becomes necessary for browsing the intricacies of high-value home purchases.

Eligibility Demands

To get approved for a jumbo loan, customers should satisfy details eligibility demands that differ from those of traditional financing. One of the main criteria is a greater credit history score, typically needing a minimum of 700. Lenders analyze creditworthiness rigorously, as the increased funding quantities entail higher danger.

Additionally, jumbo car loan applicants normally require to supply evidence of considerable income. Numerous lenders prefer a debt-to-income proportion (DTI) of 43% or reduced, although some might permit as much as 50% under particular scenarios. This makes sure consumers can handle their monthly settlements without economic stress.

Furthermore, considerable properties or reserves are typically required. Lenders may request for at least six months' well worth of home mortgage repayments in liquid assets, showing the borrower's capacity to cover expenditures in situation of income interruption.

Finally, a larger deposit is popular for big car loans, with several loan providers anticipating at the very least 20% of the acquisition rate. This demand mitigates threat for lenders and indicates the customer's commitment to the financial investment. Satisfying these strict eligibility requirements is vital for protecting a big finance and successfully navigating the premium genuine estate market.

Rates Of Interest and Costs

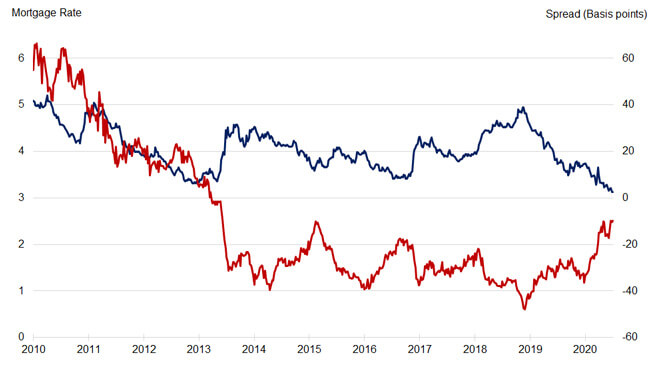

Recognizing the complexities of passion prices and charges linked with big car loans is essential for potential consumers. Unlike adjusting fundings, jumbo lendings, which surpass the adhering car loan restrictions established by Fannie Mae and Freddie Mac, generally included higher rate of interest. This rise is attributable to the perceived danger loan providers handle in moneying these bigger car loans, as they are not backed by government-sponsored ventures.

Rates of interest can vary substantially based upon numerous variables, consisting of the borrower's credit rating, the loan-to-value proportion, and market problems. It is vital for consumers to go shopping around, as various lenders might provide differing prices and terms. In addition, big car loans might include greater costs, such as source fees, evaluation costs, and personal home loan insurance (PMI) if the deposit is much less than 20%.

To lessen expenses, borrowers ought to meticulously evaluate the cost frameworks of various loan providers, as some might supply lower rates of interest yet higher costs, while others may supply a much more balanced technique. Eventually, recognizing these elements aids consumers make informed choices and enhance their financing options when acquiring deluxe residential properties.

Advantages of Jumbo Finances

Jumbo finances use considerable benefits for buyers seeking to acquire high-value buildings. Among the primary advantages is that they offer accessibility to funding that exceeds the adhering funding restrictions set by the Federal Real Estate Financing Firm (FHFA) This enables purchasers to protect bigger lending amounts, making it feasible to obtain lavish homes or residential properties in very desired areas.

Furthermore, jumbo lendings commonly feature competitive interest prices, particularly for consumers with strong credit accounts. This can lead to considerable savings over view it now the life of the financing. Jumbo financings generally enable for a range of car loan terms and frameworks, providing versatility to tailor the funding to fit private economic circumstances and long-term goals.

An additional secret advantage is the possibility for lower down settlement needs, depending on the lending institution and debtor qualifications. This enables purchasers to enter the high-end actual estate market without needing to devote a significant ahead of time capital.

Finally, jumbo financings can give the opportunity for higher cash-out refinances, which can be helpful for property owners seeking to tap right into their equity for other investments or significant expenditures - jumbo loan. On the whole, big car loans can be an effective device for those navigating the top tiers of the real estate market

Tips for Getting Funding

Securing financing for a jumbo financing needs mindful preparation and a calculated method, particularly offered the special attributes of these high-value home mortgages. Begin by examining your financial health and wellness; a durable credit history, typically above 700, is important. Lenders view this as an indication of dependability, which is essential for big fundings that go beyond conforming more lending limitations.

Involving with a mortgage broker experienced in jumbo loans can give valuable insights and accessibility to a broader variety of financing choices. They can aid navigate the complexities of the authorization procedure, guaranteeing you find competitive prices. Lastly, be gotten ready for a more rigorous underwriting process, which may consist of additional scrutiny of your financial background. By adhering to these pointers, you can improve your opportunities of efficiently securing financing for your jumbo car loan.

Conclusion

To conclude, big financings provide one-of-a-kind benefits for customers seeking high-value buildings, supplied they fulfill particular qualification criteria. With requirements such as a strong credit rating, low debt-to-income proportion, and significant down settlements, prospective home owners can access deluxe property possibilities. By contrasting rate of interest and collaborating with experienced home loan brokers, individuals can improve their home acquiring potential and make notified monetary decisions in the affordable realty market.

Browsing the intricacies of big loan financing can significantly boost your home acquiring prospective, specifically for high-value homes that go beyond standard finance limitations.In the realm of home mortgage financing, big finances serve as a critical option for consumers looking for to purchase high-value properties that surpass the adhering car loan limits established by government-sponsored enterprises. Unlike adhering financings, big fundings, which go beyond the adhering loan limitations set by Fannie Mae and Freddie Mac, usually come with greater passion prices. Big loans usually enable for a selection of loan terms and structures, providing flexibility to customize the funding to fit specific financial situations and lasting objectives.

Lenders view this as a sign of integrity, which is vital for jumbo finances that go beyond adjusting funding restrictions. (jumbo loan)

Report this page